- ABOUT US

-

CHAMBERS & COUNCILS

- Chambers, Councils & Committees Overview

-

Cities & Communities

>

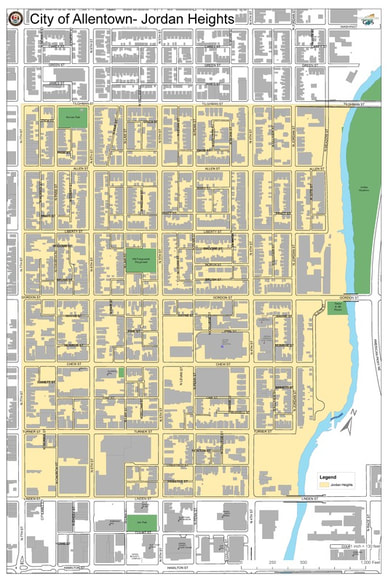

- Chamber Map

- Allentown Area Chamber >

- Bethlehem Area Chamber >

- Downtown Bethlehem Association | Lehigh Valley Chamber

- Carbon Chamber & Economic Development Corporation

- East Penn Area Chamber >

- Easton Area Chamber >

- Emmaus Main Street Partners >

- Forks Business Association >

- Greater Northampton Area Chamber >

- Greater Northern Lehigh Chamber

- Hellertown Lower Saucon Area Chamber

- Nazareth Area Chamber

- Phillipsburg Area Chamber >

- Pocono Chamber of Commerce

- Southern Lehigh Area Chamber

- Western Lehigh Area Chamber

- Whitehall Area Chamber

- Business Councils >

-

Diversity Councils

>

- EVENTS

- Public Policy

-

MEMBERSHIP

- BUSINESS DIRECTORY

-

COMMUNITY

- ABOUT US

-

CHAMBERS & COUNCILS

- Chambers, Councils & Committees Overview

-

Cities & Communities

>

- Chamber Map

- Allentown Area Chamber >

- Bethlehem Area Chamber >

- Downtown Bethlehem Association | Lehigh Valley Chamber

- Carbon Chamber & Economic Development Corporation

- East Penn Area Chamber >

- Easton Area Chamber >

- Emmaus Main Street Partners >

- Forks Business Association >

- Greater Northampton Area Chamber >

- Greater Northern Lehigh Chamber

- Hellertown Lower Saucon Area Chamber

- Nazareth Area Chamber

- Phillipsburg Area Chamber >

- Pocono Chamber of Commerce

- Southern Lehigh Area Chamber

- Western Lehigh Area Chamber

- Whitehall Area Chamber

- Business Councils >

-

Diversity Councils

>

- EVENTS

- Public Policy

-

MEMBERSHIP

- BUSINESS DIRECTORY

-

COMMUNITY